Our Responsible Investment Initiatives

Supporting Value Creation in the Investment Chain

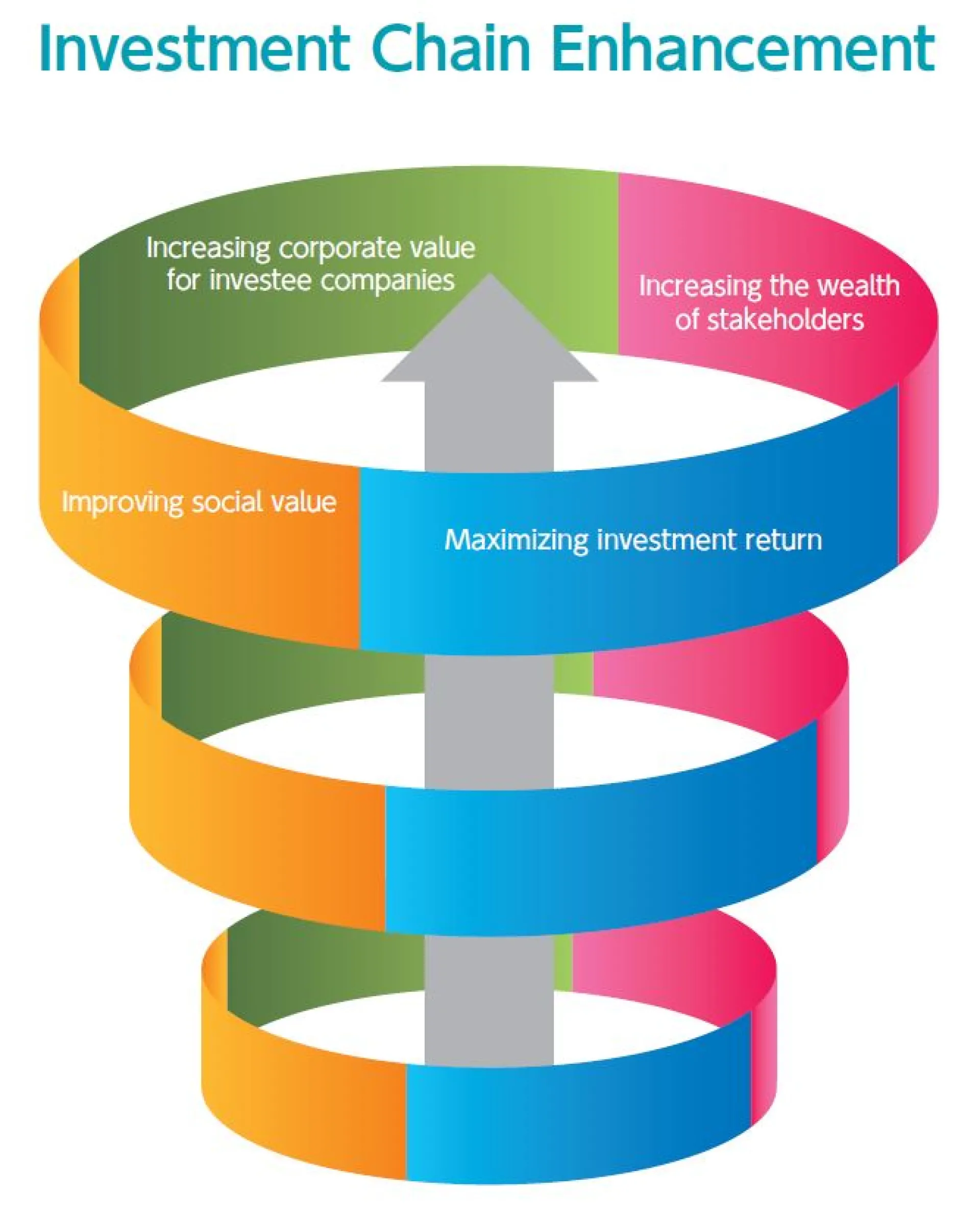

Investors, their investee companies, and each stakeholder work together based on common values. Sustainable growth and increased corporate value along with growth in dividends and wages will ultimately benefit household economies, which in turn, leads to growth of the economy as a whole. All of this together is known as the investment chain.

At SuMi TRUST AM, we actively utilise our role as an asset manager in the investment chain to support our investee companies create corporate value, leading to maximum returns for our clients, while at the same time helping to resolve social issues.

Our mission is to maximize medium- to long-term return on investment for clients by improving corporate value over a medium- to long-term period for investee companies, and acquiring excess return through investment while raising the market as a whole. To accomplish these, we identify issues with each investee company, and conduct effective and efficient engagement.

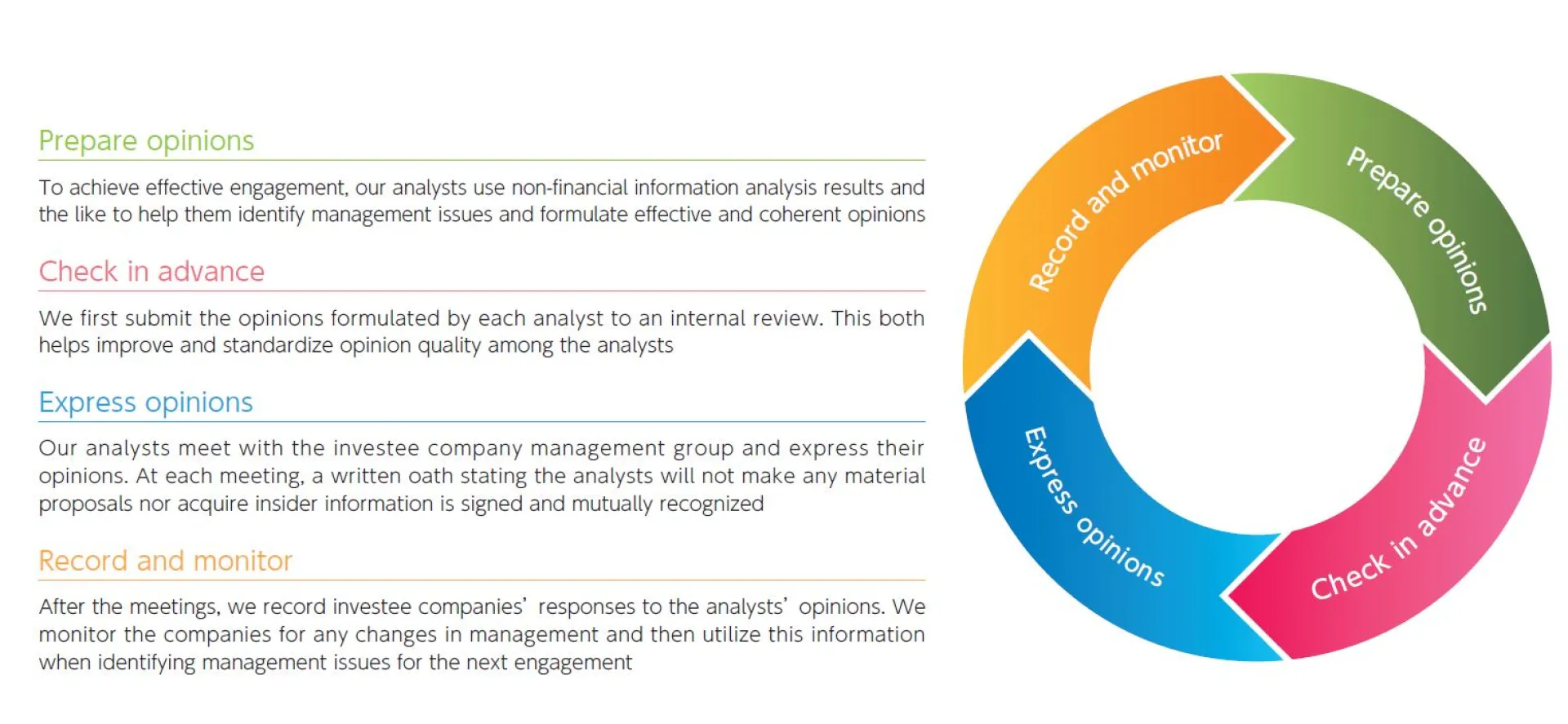

Our engagement consists of (1) the market cap approach, (2) the risk approach, and (3) the top-down approach. We select target companies for the top-down approach on the basis of our 12 ESG materialities, and perform stage management for engagement.

Our Engagement Process

As a responsible investor, with $623 billion assets under management (AUM) as of 31 March 2024, stewardship activities are an integral part of our investment process. By helping investee companies improve their ESG position, we can maximise long-term investment returns for our clients. Our stewardship activities consist of three key pillars: engagement with companies (constructive and purposeful dialogue), the exercise of voting rights and initiatives that encourage companies to improve their response to ESG issues.

Aiming for impactful results, we collaborate with global initiatives: we are signatories of the UN Principles for Responsible Investment (PRI) since 2006 and the Net Zero Asset Managers initiative (NZAMI), as examples. Our stewardship activities are led by a dedicated team based in Tokyo, the UK and the US, working closely with our credit and equity research analysts.