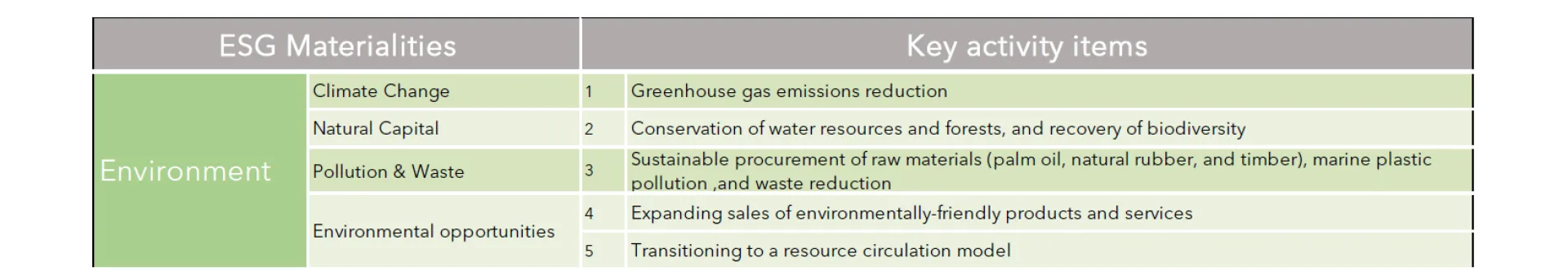

Graph 1: Concepts supporting workstyle reforms

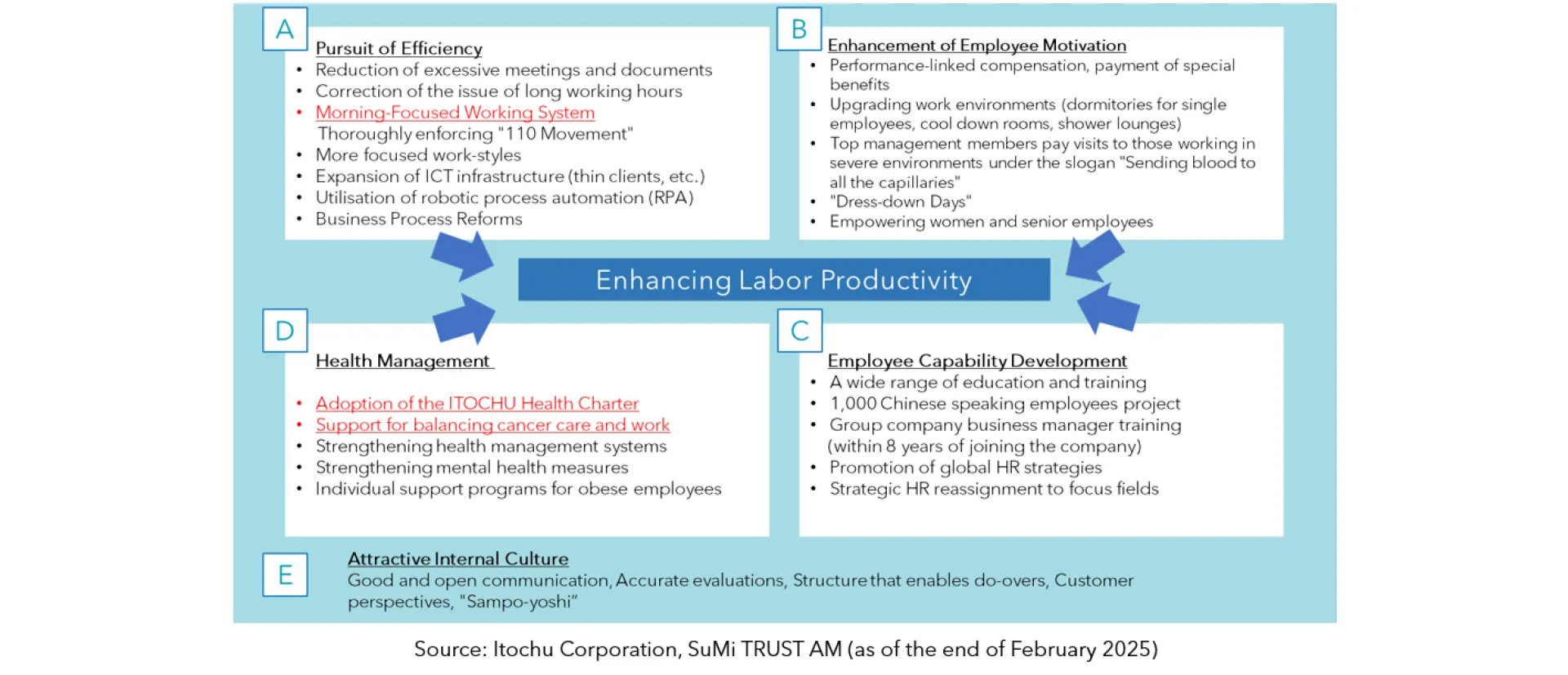

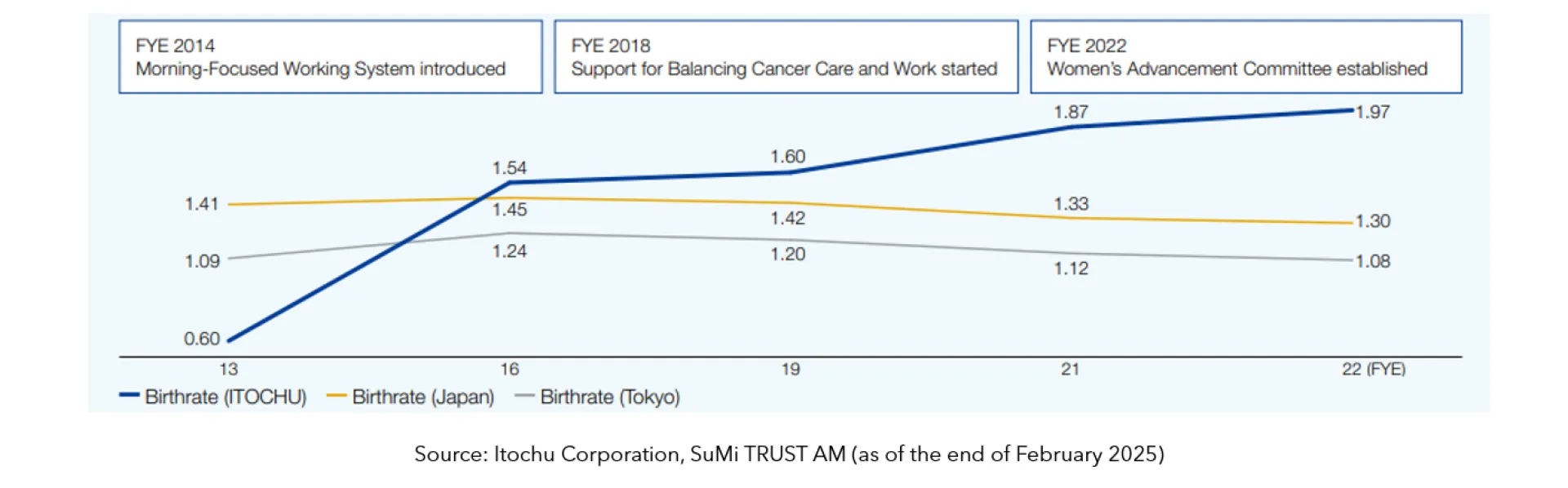

Finally, let’s look at how labour productivity has changed due to such initiatives. Figures 2, 3 and 4 show charts on the company's birth-rate, gender pay gap, employee numbers, and consolidated net profit over more than 10 years since the inception of its work style reforms in 2010. Although the comparison base is different (the number of employees is on a non-consolidated basis and the net profit is on a consolidated basis), it is evident that the company's consolidated net profit has been on an upward trajectory even as employee numbers remained nearly flat, confirming the improvement in labour productivity envisioned by the company.

Graph 2: Trends in birth rates

Graph 3: Gender pay gap, Graph 4: Number of employees and net profit

Thus, Itochu's work style reforms are not just about changing work practices; they highlight a significant transformation in corporate culture and values. From a medium to long-term perspective, these reforms are essential for sustainable corporate growth. By realising satisfying work styles for each employee, the overall labour productivity and corporate competitiveness can be improved.

In Conclusion: SuMi TRUST AM’s Initiatives

Work style reforms bring substantial benefits not only to companies but also to society. They enhance employee well-being, contribute to solving societal issues, and serve as important steps toward sustainable development. The initiatives undertaken by Itochu Corporation provide valuable lessons for many other companies and are likely to remain in the spotlight.

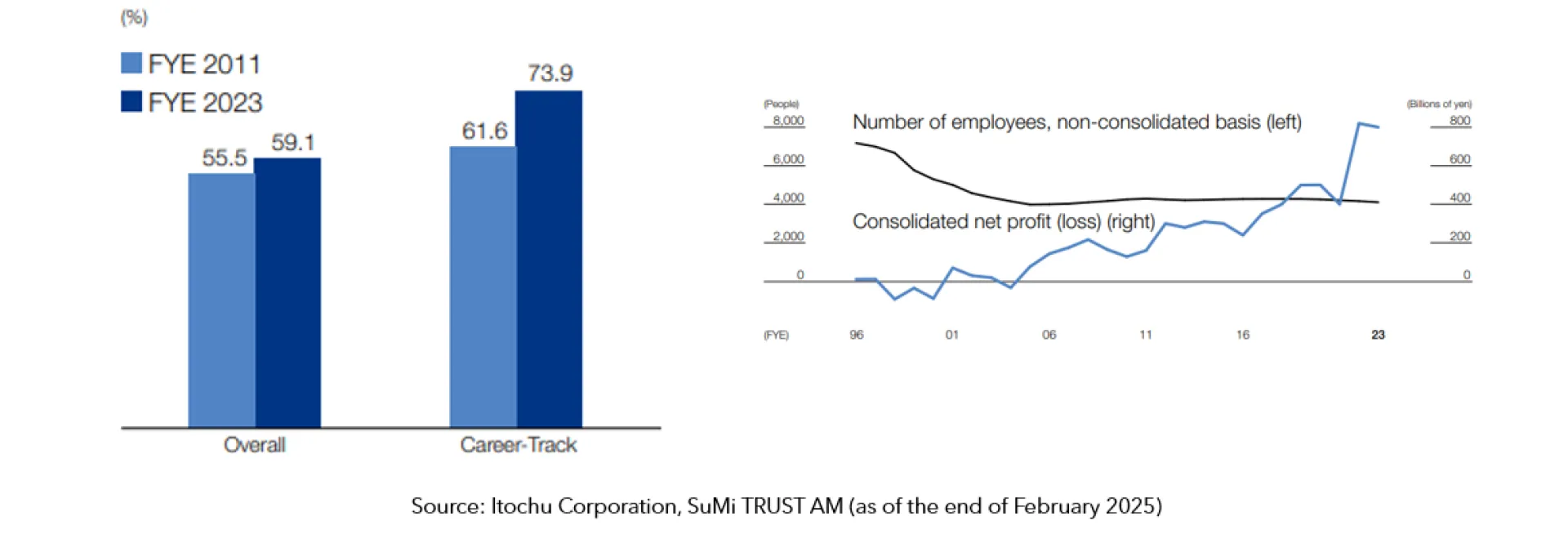

At Sumitomo Mitsui Trust Asset Management (hereafter "SuMi TRUST AM"), we aim to support such corporate initiatives as responsible institutional investors. By engaging with ESG (Environmental, Social, Governance) issues and voting based on 12 ESG materiality criteria (Figure 5), we strive to enhance the value of our investee companies. We continue to engage in discussions on human capital initiatives and gender gap reduction, showcasing good examples like Itochu to other companies. By promoting constructive engagement towards enhancing the overall corporate value of the Japanese market, we aim to drive sustainable growth in the medium to long term and enhance the value of the assets entrusted to us.

Graph 5: SuMi TRUST AM’s 12 ESG materialities