Japanese stocks rose sharply in the first half of 2024

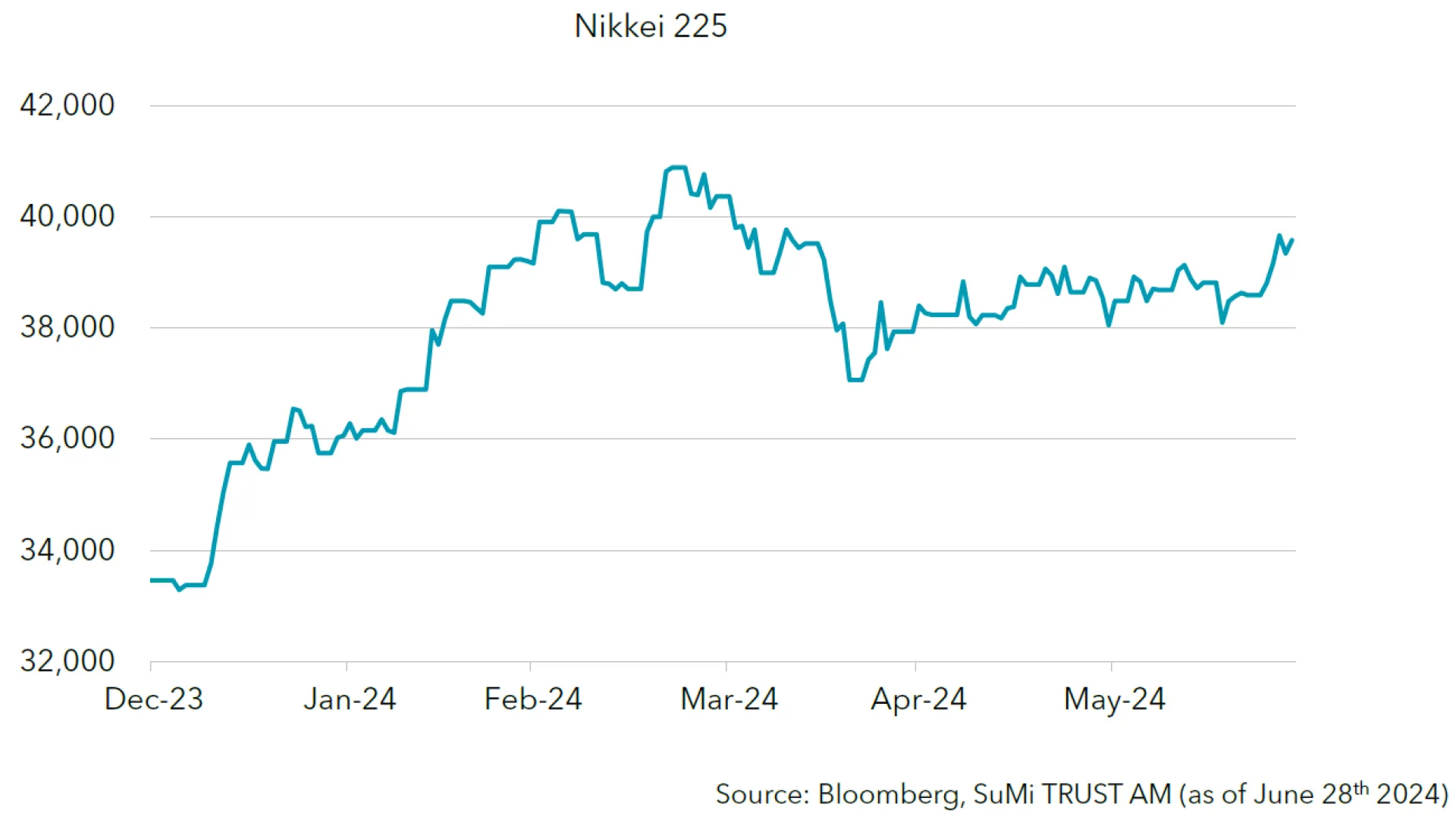

We are halfway into 2024 and the Nikkei 225 has rallied sharply since the start of the year, reaching the 40,000-yen level momentarily in March. Although there was a correction in April, the market has gained 18% YTD as of the end of June.

The Nikkei 225 rose sharply from January, led by foreign investor purchases, mainly in high-priced stocks (stocks with relatively high absolute prices) and large cap stocks. From February onwards, the rally spread to undervalued stocks. Amid positive sentiment buoyed by the strong U.S. equity market and a weaker yen, foreign investors have continued to be net buyers of Japanese equities on the assumption that the Bank of Japan will maintain its accommodative stance even after the lifting of its negative interest rate policy, and the Nikkei 225 reached a record high (the previous high was 38,915 at the end of December 1989). In its March monetary policy meeting, the Bank of Japan decided to end its negative interest rate policy, and the Nikkei 225 reached a high of 40,888 yen on expectations of an end to deflation and a weaker yen.

From April, uncertainty over earnings in the semiconductor production equipment sector and geopolitical concerns in the Middle East led to profit-taking. Thereafter, we saw a rebound as the situation in the Middle East eased. However, weak guidance by companies in May and uncertainty over BOJ monetary policy weighed on the market, and the market moved sideways. The Nikkei 225 closed at 39,583 yen at the end of June.

We envision four key points that will affect the Japanese stock market: Tokyo Stock Exchange (TSE) market reforms, the new NISA (capital gains tax exempt investment/savings scheme), Japan's relative advantage in global terms, and overcoming deflation. In the subsequent paragraphs, we will look at progress in these four key areas.

TSE Market Reforms, New NISA reveals results

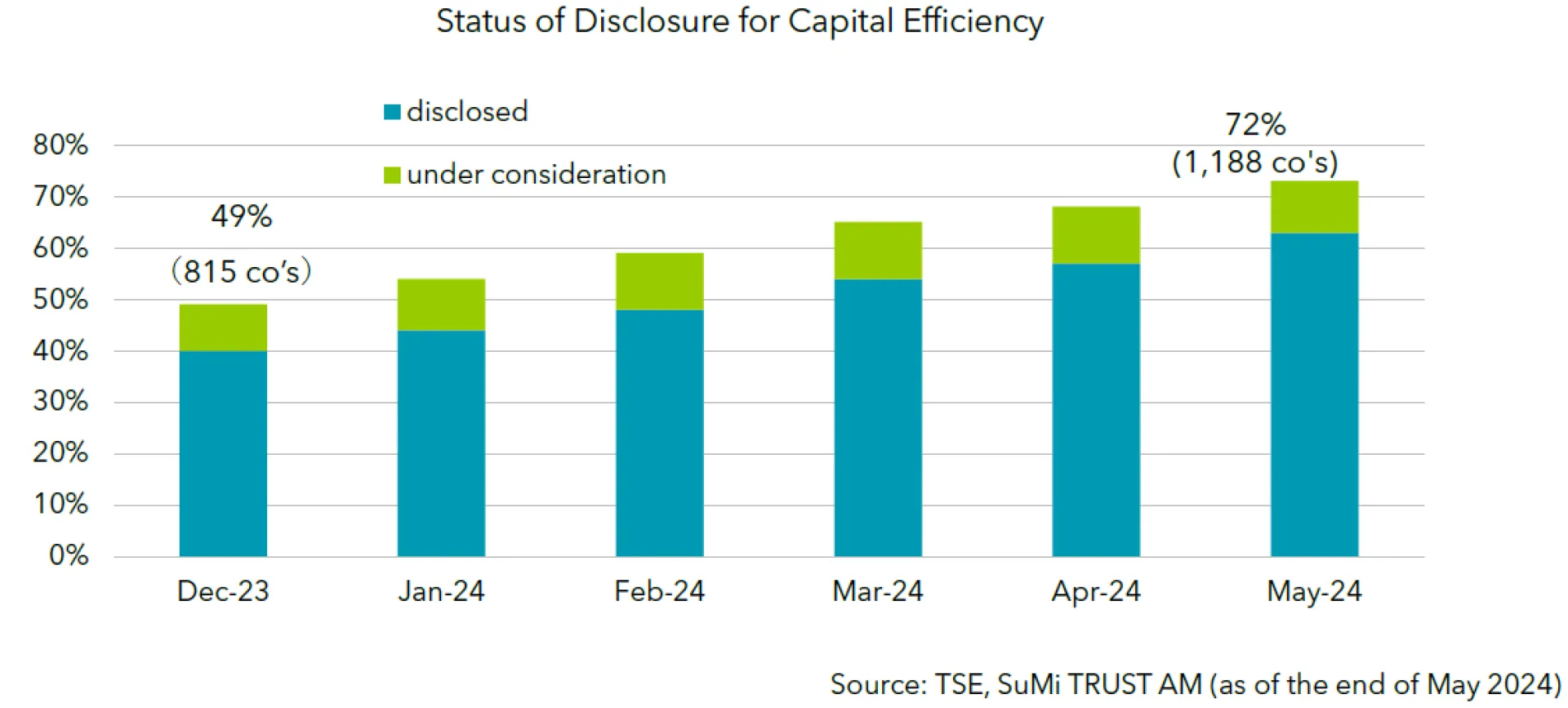

The TSE's market reforms (requiring listed companies with sub-par Price-to-Book (P/B) ratios to disclose and implement improvement measures) are already showing results. According to the TSE, on "measures to realise cost of capital and share price conscious management," 72% (1,188 companies) of prime market companies have disclosed or are considering such measures as of May 2024 (compared to 49% or 815 companies as of Dec. 2023). Of these companies, 93% of large caps (i.e. market capitalisation of 100 billion yen or more) with a P/B ratio of less than 1x, have disclosed (or are considering disclosing) their initiatives. Concrete actions, such as raising the dividend pay-out ratio and conducting share buybacks, are already underway, and progress has exceeded initial expectations.

In addition, on June 19th, the Japan Stock Exchange (“JPX”) announced that it would begin reviewing the reclassification of TOPIX constituent stocks, targeting all market segments (Prime, Standard, and Growth markets) that are eligible for investment.

The first periodic reshuffling will take place in October 2026, and the weighting of stocks to be excluded from the TOPIX will be reduced every 3 months in 8 phases. The second periodic reclassification will take place in October 2028, and the number of stocks to be included will be reduced from the current 2,100 to approximately 1,200. Through these measures, the TSE market reforms are expected to advance even further.

As for the new NISA which was rolled out in January, the total of deposits amounted to roughly 6.18 trillion yen as of the end of March. Of this amount, 56.7% went into investment trusts and 40.2% into listed stocks. While most of the trusts are invested in internationally diversified funds, more than 90% of the listed stocks were domestic stocks, which is believed to have had a supportive effect on Japanese equities.

Japan's relative advantage should also continue for the time being

Japan's relative advantage in global terms is likely to continue for some time. Chinese stocks (Shanghai Composite Index), which had been weak since last summer, began to rise after bottoming out in early February, partly due to expectations of government stimulus measures. The CPI (Consumer Price Index) in February was positive for the first time since August of last year, and the Chinese economy appeared to be headed for recovery. However, real estate development for the period from January to May declined by 10.1% YoY, indicating that the real estate problem, the supposed root of the economic downturn in China, continues to show no signs of improvement.

In addition, although inflation has eased in the U.S., interest rates have yet to be cut, and the policy rate remains high at over 5%. Significant capital inflows from here are hard to imagine due to a potential fall in the U.S. dollar against other major currencies.

In Europe, the ECB (European Central Bank) cut interest rates in June, and monetary easing has been seen in the market as inflation has settled, providing some relief. Meanwhile, in France, the National Assembly (lower house of parliament) was dissolved amid the rise of the far-right and far-left parties. Although a far-right government was avoided, the Assembly was divided. In the U.K., a general election was held in July and the Conservatives were ousted in favour of Labour, resulting in the first left-wing UK government in 14 years.

Political turmoil in Europe is likely to continue for some time. In Japan, political risks are also increasing, but the LDP-led government is expected to remain in power, and the relative risk is not considered significant.

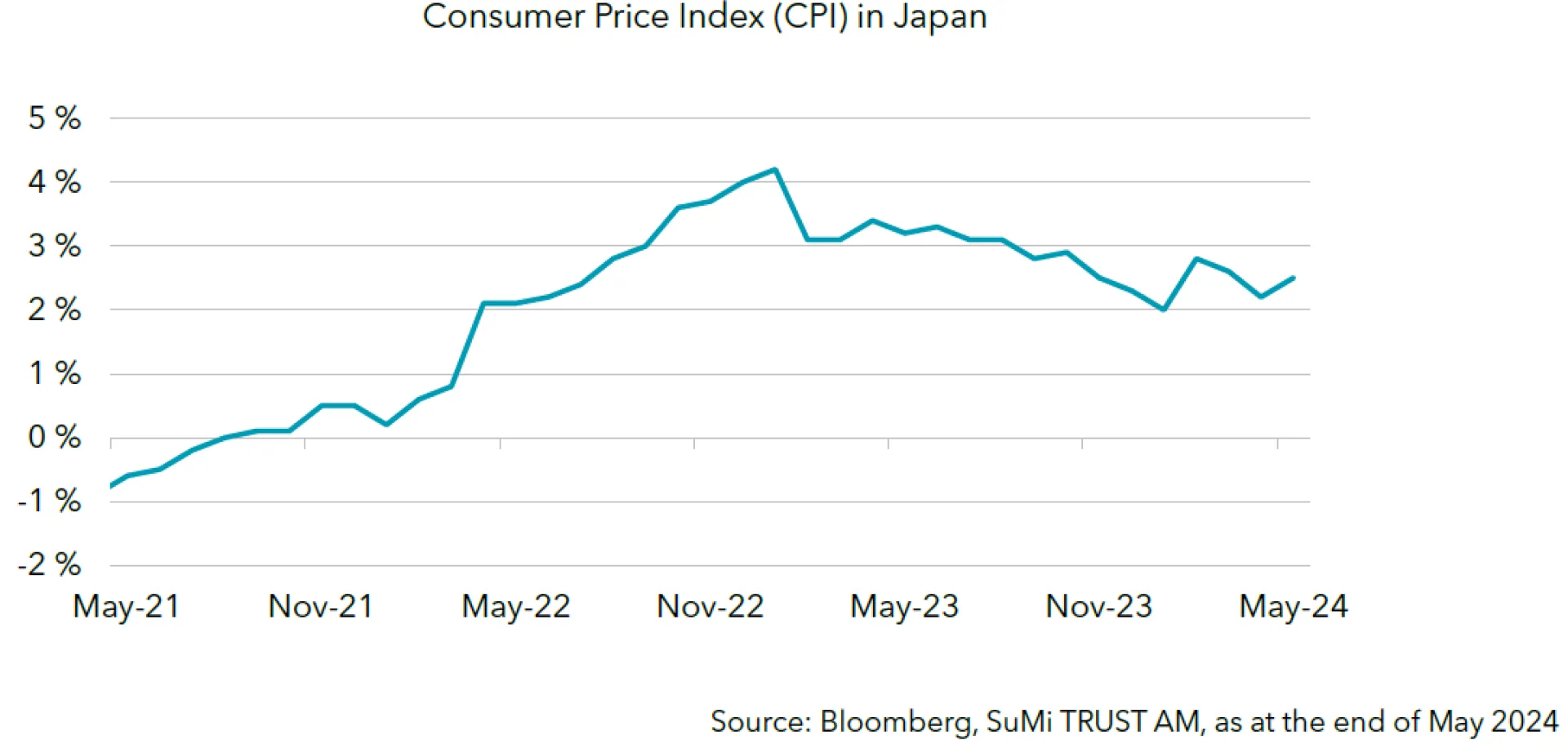

Overcoming deflation will be a major focus

Overcoming deflation will be a major focus going forward. Since the summer of 2021, Japan's CPI (composite index excluding fresh food, core CPI) has remained positive YoY. In 2023, core CPI was +3.1% YoY, the highest in 41 years; in May, core CPI was also +2.5% YoY, above the government target of 2%. In addition, the sixth round of responses to spring labour-management wage negotiations showed an average wage increase of more than 5%. On the other hand, the government has yet to declare an end to deflation due to concerns over the economic outlook and other factors. This seems to suggest that the government believes the conditions to enter a virtuous cycle of price hikes and wage increases have not yet been reliably realised. At present, we still have a long way to go, but we expect the stock market to receive a boost if a "full-fledged break from deflation" is achieved.

Immediate Risks

We will review the risks to the Japanese market for the second half of 2024. Although not highly likely, the most significant economic impact is (1) the risk of failing to end deflation. If the public cannot keep up with rising prices (higher consumer prices), there is concern that the economy will either revert to deflation or go into recession amid rising prices. In that case, there is the risk that the Bank of Japan will have difficulty normalising monetary policy (raising interest rates) and the economy will revert back to the lost 30 years (long-term recession) of 1990-2020. In addition, (2) domestic political risks remain. With the Kishida administration's approval rating sinking to the lowest level since its inauguration, even the ruling party is discussing a change in its leadership. Political turmoil may cause foreign investors to flee the country. (3) Overseas politics are also a risk. Political turmoil in Europe and turmoil in the U.S. in the run-up to the presidential election are concerns for the globally risk averse.

Despite these risks in the near term, from a long-term perspective, we expect capital inflows into Japanese equities to continue.